COUNTDOWN TO PROCEDURAL REALITY

Media Monopoly and Extraction Economics

Modern media monopolies do not exist to inform. They exist to extract — attention, capital, narratives, and time. Consolidation is not innovation; it is rent-seeking at scale, where the same few gatekeepers recycle power, suppress scrutiny, and monetize delay.

Silence is not an accident. It is priced in.

Extraction economics works by stretching process until the public is exhausted, regulators are late, and accountability becomes administratively inconvenient. When media giants merge without full procedural daylight, value is not created — it is harvested from viewers, creators, markets, and the rule of law.

January 16th Is Not a Narrative Date

January 16th marks the moment when service, jurisdiction, consolidated filings, and recorded defaults are fixed into a Commonwealth superior court record. Courts do not wait for tender deadlines. They do not defer to market optics.

Process ends. Records fix. Extraction meets law.

Google Top Stories — ShockYA Visibility

As of publication, two of the four Google Top Stories on the Netflix–Warner merger are ShockYA! articles. This is not anecdotal. It is algorithmic visibility at scale.

Silence in the face of this visibility is not ignorance. It is conscious avoidance.

On December 27, 2025, ShockYA! issued a timestamped public notice documenting an active judicial and regulatory inflection point, including the January 16, 2026 procedural milestone and a formal request for a temporary regulatory stop order.

Failure to disclose this date is not simplification. It is omission.

Range Maintenance Journalism

By centering January 21 while omitting January 16, investor attention is redirected away from the only date that fixes legal reality. That is not neutral reporting. That is range maintenance journalism.

ShockYA! has formally requested a correction, editor’s note, or updated disclosure. This editorial is issued without prejudice. All rights reserved.

Real Talk

Thu. Jan 1st, 2026

ANALYST WARNING – NETFLIX / WARNER MERGER – UNDER REGULATORY ENFORCEMENT

Structural Lineage of Media Power

Historical context · Ownership continuity · Alleged systemic risk vectors

(Not findings of criminal liability)

- Meyer Lansky – Financial architecture (historical)

- Chicago Outfit – Syndicate-era capital coordination

- Bronfman Interests – Liquor · entertainment · capital flows

- Redstone Ownership Line – Media consolidation legacy

- Rupert Murdoch – News & entertainment power

- Bob Iger – Platform consolidation era

- Brian Roberts – Distribution & infrastructure

Alleged Systemic Risk Vectors

- Market concentration & information asymmetry

- Sports-betting integrity risks in media ecosystems

- CSAM circulation risk via large-scale platforms

- Reputational leverage & coercive settlement pressure

Capital Optics vs. Capital Reality

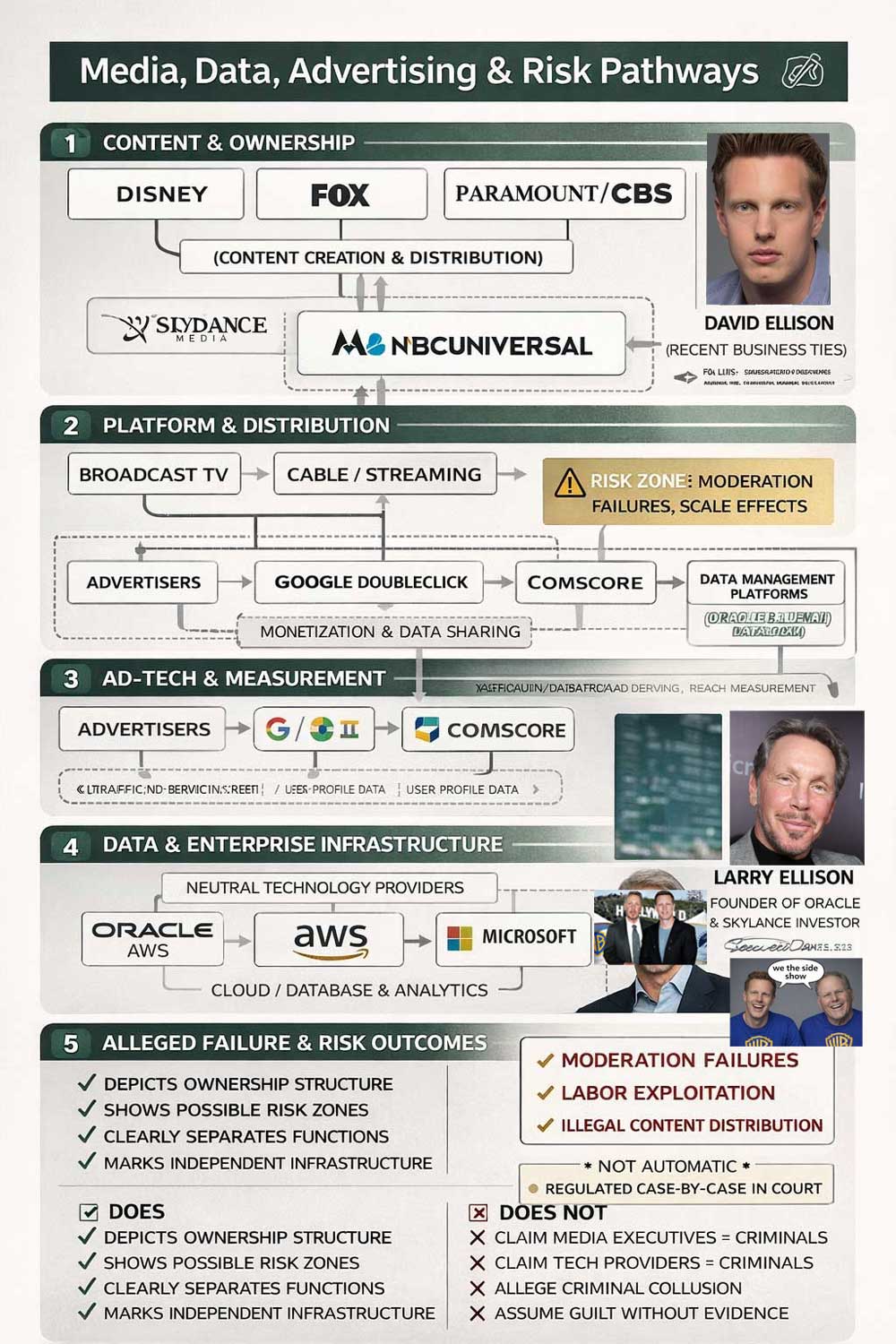

Public reporting has framed David Ellison’s role in the proposed Paramount–Skydance transaction as involving an implied “$40 billion personal loan/capital commitment from his father Larry Ellison.” In market reality, this figure functions less as deployable cash and more as transactional optics.

The revolving-door structure is central to current regulatory concern. Control consolidates without proportionate risk absorption.

Executive Risk Brief – Requested Action: Temporary Procedural STOP ORDER

Date: 31 December 2025

Jurisdictions: Antigua & Barbuda · United Kingdom · United States (California)

This brief summarizes procedural, governance, and systemic-risk considerations arising from the proposed consolidation involving Netflix, Warner-aligned entities, and legacy control structures.

Key Risk Findings

- Procedural Posture & Evidence Preservation

- Capital Optics vs. Capital Reality

- Successor Governance Exposure

- Systemic & Cross-Border Risk

- Governance Stress Indicators

On Notice – Media & Platform Executives

| Name | Position | Entity | Basis of Notice |

|---|---|---|---|

| Shari Redstone | Chair | Paramount Global / National Amusements | Legacy ownership continuity |

| David Zaslav | CEO | Warner Bros. Discovery | Executive authority over consolidation |

| Ted Sarandos | Co-CEO | Netflix | Senior platform executive |

| Reed Hastings | Founder / Chairman | Netflix | Historic governance role |

| Bob Iger | CEO | Disney | Comparative consolidation context |

| Brian Roberts | CEO | Comcast / NBCUniversal | Originating pleadings |

For deeper historical context, see the investigative piece: “Warner–Netflix Merger Is Meyer Lansky’s Hollywood Dream: Labor Racketeering, CSAM, Blackmail and Fixed Sports Betting”.